A Reset for Crypto and FAANG Stocks

If the market decline of 2022 taught investors anything, it’s that what goes up might also come down. Some of the most hyped investments of the past two years did just that. Cryptocurrencies1 and FAANG stocks2 were all hit hard, with bitcoin falling below $17,000, about 75% lower than its high of nearly $68,000 in November 2021.3 As investors have learned by now, cryptocurrencies can be extremely volatile. From a distance, bitcoin might appear to have enjoyed a steady climb through much of its existence. There were, however, major slumps: On three occasions since 2017, bitcoin has fallen by more than 50%, including the decline that extended into 2022.

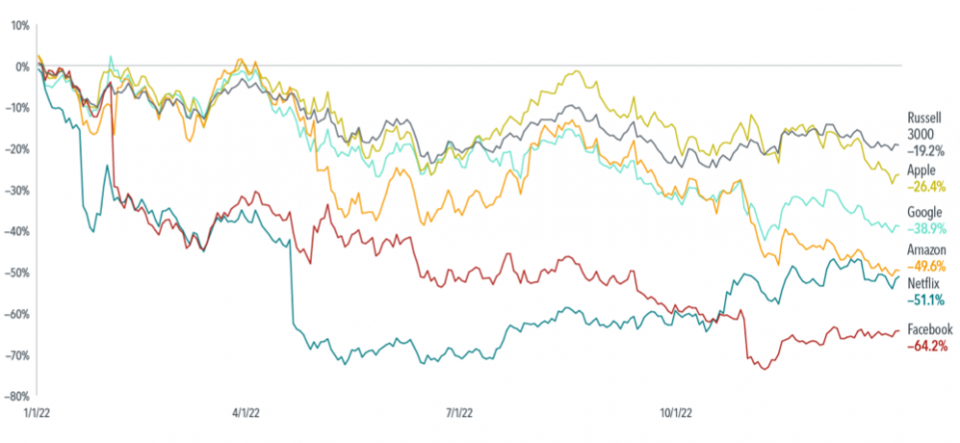

The FAANGs also saw notable declines in 2022 (see Exhibit 1). The group of tech stocks lost a combined $3.2 trillion in market value—one might say the market was de- FAANGed. Facebook parent Meta Platforms, Amazon, Apple, Netflix, and Google parent Alphabet all lagged the broad US market, with Facebook and Netflix suffering particularly sharp losses. The group collectively underperformed the Russell 3000 Index4 by more than 20 percentage points.5 The slump came on the heels of a stellar decade— the FAANGs returned 28% per year from 2012 to 2021.

Exhibit 1: Tech Giants De- FAANGed

Past performance is no guarantee of future results.

In USD. Cumulative returns, January 1, 2022–December 31, 2022. FAANG stock data source: Refinitiv. Facebook and Google now known as Meta and Alphabet, respectively. Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio.

That reversal is a reminder that investors should be cautious about assuming past returns will continue. Even if a company with a track record of strong stock returns remains broadly successful, that may not translate to spectacular future returns. Excellence may now be what investors are counting on and not the basis for above-market returns. This point is borne out by looking back at stocks as they grew to become among the top 10 largest by market cap. On average, their performance lagged the performance of the broader market within a few years of entering the top 10.

Footnotes:

- As of the date of this material, Dimensional does not offer investment in cryptocurrency. This material is not to be construed as investment advice or a recommendation to buy or sell any security or currency.

- The FAANG stocks are Facebook (Meta Platforms), Amazon, Apple, Netflix, and Google (Alphabet).

- Source: Bloomberg and Refinitiv.

- Frank Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes. Indices are not available for direct investment; therefore, their performance does not reflect the expenses associated with the management of an actual portfolio. Index has been included for comparative purposes only.

- FAANG stock returns are computed as the average of Facebook (Meta), Apple, Amazon, Netflix, and Google (Alphabet share classes A and C) weighted by market capitalization at beginning of month. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security. Named securities may be held in accounts managed by Dimensional.

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd. and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

Risks

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.