Third Quarter Market Review

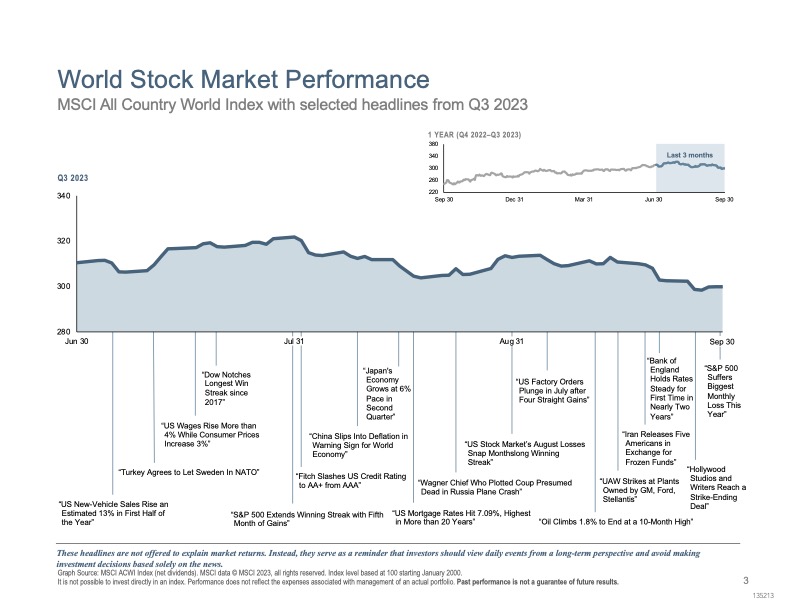

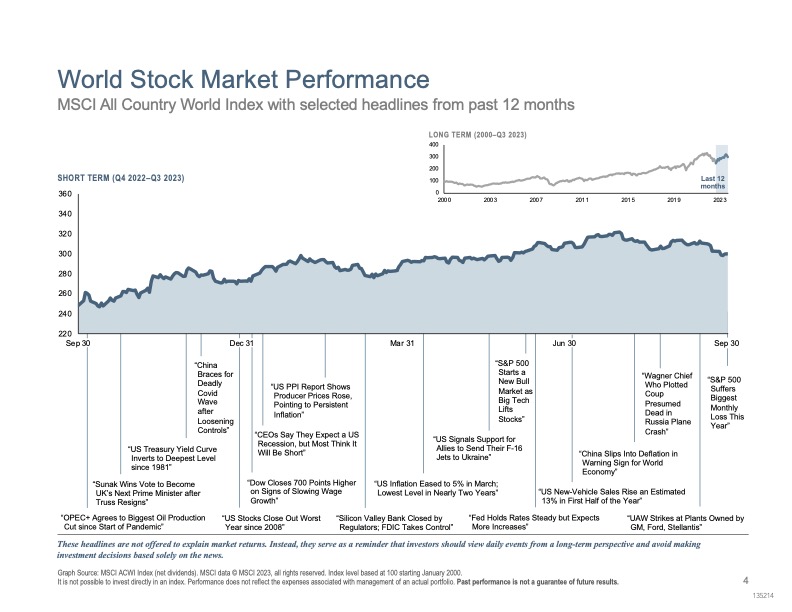

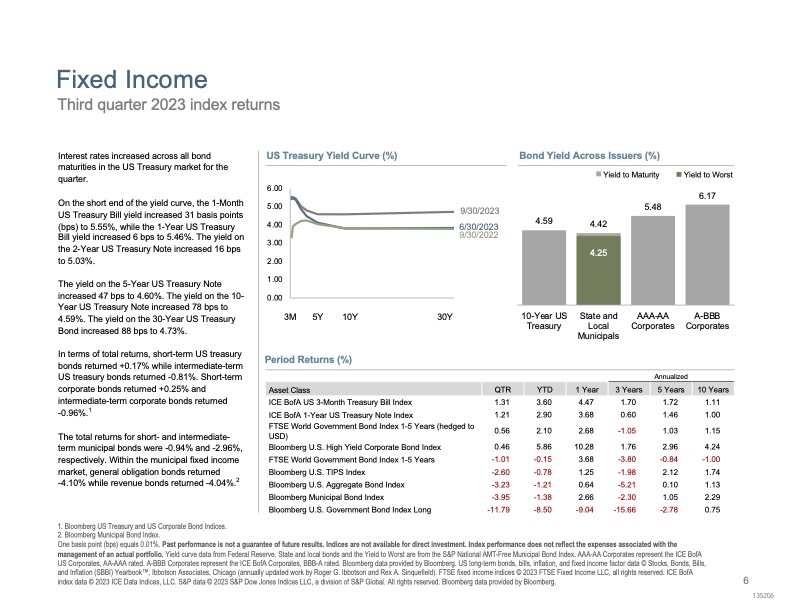

Global stocks dropped after last quarter’s positive performance, with the MSCI All Country World IMI Index returning -3.4% over the quarter and underperforming global bonds for the first time in the past year, as measured by the Bloomberg Global Aggregate Bond Index. 5-year forward inflation expectations in the United States remained below 3% for the quarter, as the yield curve remained inverted for more than a year according to the 2- and 10-year spread. In particular, the 10-year Treasury yield rose by nearly 80 basis points to 4.6% this quarter, marking its highest level in approximately 16 years.

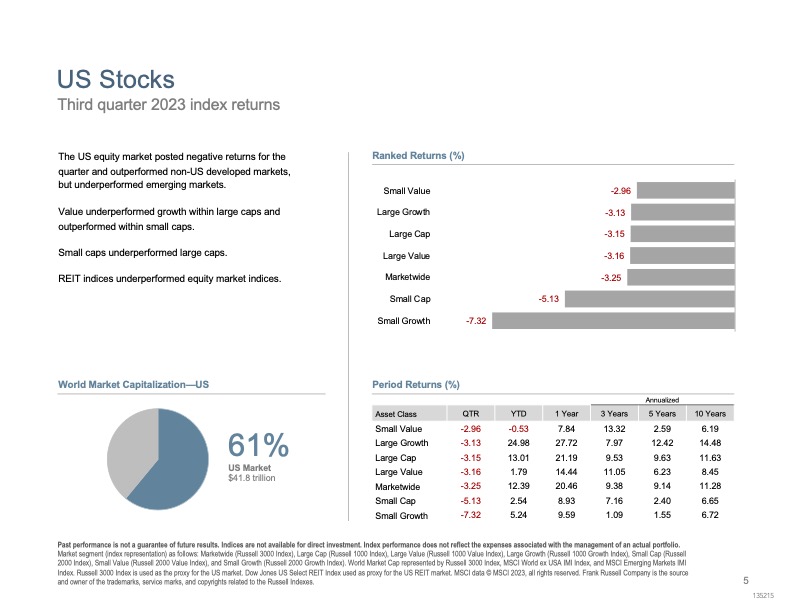

Globally, energy rebounded from its weaker performance in the first half of 2023 and was the best performing sector, returning 11.5% for the quarter. Comparatively, information technology, REITs, and utilities lagged the overall market. Large growth stocks were the biggest detractors,

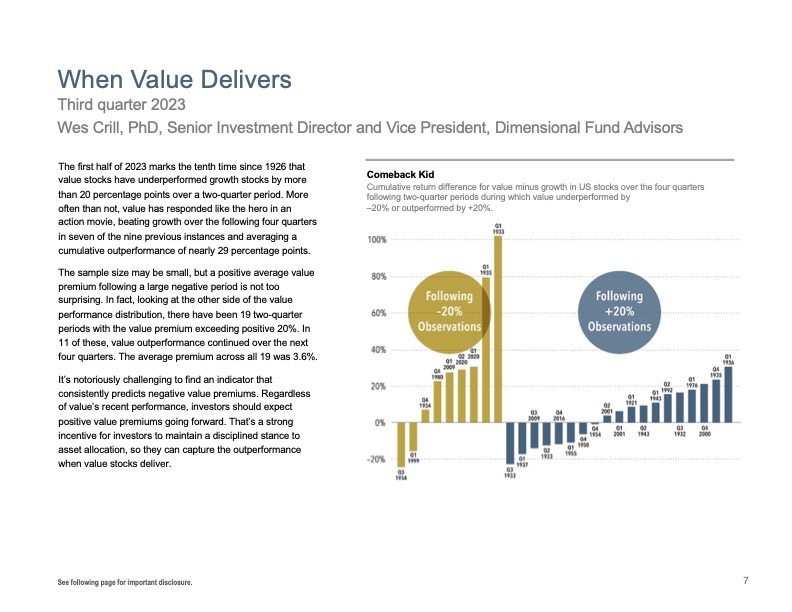

as names like Apple returned -11.6% while Microsoft returned -7.1%. Value stocks generally outperformed growth stocks across US, non-US developed, and emerging markets, with the MSCI All Country World Value IMI Index outperforming its growth counterpart by 3.1%. In the US, the value premium was positive despite generally negative size and profitability premiums. Other developed markets saw positive size premiums yet faced negative profitability premiums, whereas emerging markets saw both positive size and profitability premiums. Despite mixed size and profitability premiums across regions, the value premium in the United States and globally was strong for the quarter, as value stocks outperformed growth stocks in every region and generally across small and large caps. The value premium was especially strong within developed markets outside of the US, with the MSCI World ex USA Value index outperforming the MSCI World ex USA Growth index by 8.4% for the quarter.

Past performance is no guarantee of future results.

In USD. July 1926–June 2023. Quarterly returns for value and growth based on the Fama/French US Value Research Index and the Fama/French US Growth Research Index, respectively. Data provided by Fama/French. The Fama/French indices represent academic concepts that may be used in portfolio construction and are not available for direct investment or for use as a benchmark. Index returns are not representative of actual portfolios and do not reflect costs and fees associated with an actual investment. See “Index Descriptions” for descriptions of the Fama/French index data.

Index Descriptions: Fama/French US Value Research Index: Provided by Fama/French from CRSP securities data. Includes the lower 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973). Fama/French US Growth Research Index: Provided by Fama/French from CRSP securities data. Includes the higher 30% in price-to-book of NYSE securities (plus NYSE Amex equivalents since July 1962 and Nasdaq equivalents since 1973).

Disclosures

All expressions of opinion are subject to change. This information is not meant to constitute investment advice, a recommendation of any securities product or investment strategy (including account type), or an offer of any services or products for sale, nor is it intended to provide a sufficient basis on which to make an investment decision. Investors should consult with a financial professional regarding their individual circumstances before making investment decisions. Diversification neither assures a profit nor guarantees against loss in a declining market.

The information in this material is intended for the recipient’s background information and use only. It is provided in good faith and without any warranty or representation as to accuracy or completeness. Information and opinions presented in this material have been obtained or derived from sources believed by Dimensional to be reliable, and Dimensional has reasonable grounds to believe that all factual information herein is true as at the date of this material. It does not constitute investment advice, a recommendation, or an offer of any services or products for sale and is not intended to provide a sufficient basis on which to make an investment decision. Before acting on any information in this document, you should consider whether it is appropriate for your particular circumstances and, if appropriate, seek professional advice. It is the responsibility of any persons wishing to make a purchase to inform themselves of and observe all applicable laws and regulations. Unauthorized reproduction or transmission of this material is strictly prohibited. Dimensional accepts no responsibility for loss arising from the use of the information contained herein.

This material is not directed at any person in any jurisdiction where the availability of this material is prohibited or would subject Dimensional or its products or services to any registration, licensing, or other such legal requirements within the jurisdiction.

“Dimensional” refers to the Dimensional separate but affiliated entities generally, rather than to one particular entity. These entities are Dimensional Fund Advisors LP, Dimensional Fund Advisors Ltd., Dimensional Ireland Limited, DFA Australia Limited, Dimensional Fund Advisors Canada ULC, Dimensional Fund Advisors Pte. Ltd., Dimensional Japan Ltd., and Dimensional Hong Kong Limited. Dimensional Hong Kong Limited is licensed by the Securities and Futures Commission to conduct Type 1 (dealing in securities) regulated activities only and does not provide asset management services.

RISKS

Investments involve risks. The investment return and principal value of an investment may fluctuate so that an investor’s shares, when redeemed, may be worth more or less than their original value. Past performance is not a guarantee of future results. There is no guarantee strategies will be successful.

Dimensional Fund Advisors LP is an investment advisor registered with the Securities and Exchange Commission.

Investment products: • Not FDIC Insured • Not Bank Guaranteed • May Lose Value

Dimensional Fund Advisors does not have any bank affiliates.